Blog

Insurer not liable for dishonest conduct in deregistered company

After a financial broker misappropriated his clients' funds, they brought a case against his insurer. Read about the case and findings here.

Worker awarded >$600k for sexual assault by manager

Read about a case where a worker was awarded over $600K for sexual assault by a manager on a work trip to Sydney. See the ...

Insurer required to fund rehabilitation despite DNA evidence

Read about a case where an insurer must fund rehabilitation despite DNA evidence suggesting the applicant was at fault in a car accident.

On appeal: QSC marine engine repairs decision

Case note: Ireland v B & M Outboard Repairs [2015] QSC 84 Facts The Plaintiff, Colin Ireland, brought a claim for neck and psychiatric injuries from ...

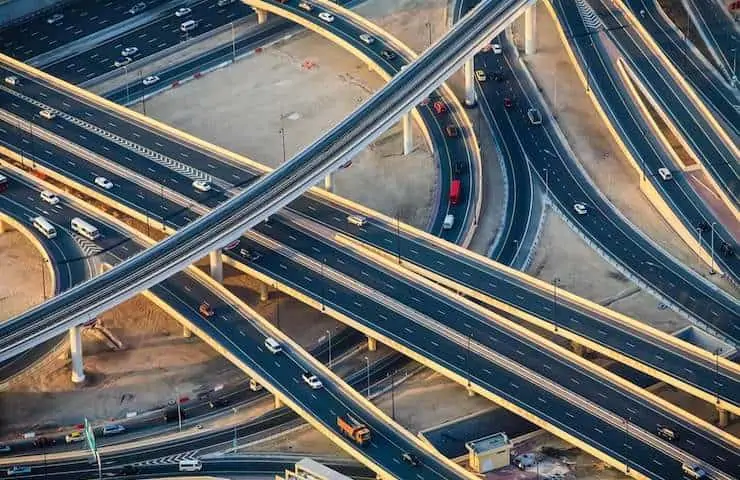

Managing indemnity disputes after Highway Hauliers

This was a judgment of the District Court of Western Australia on a preliminary question of law in a personal injury case. Find out more ...

QCA extends limitation period in medical negligence case

Read about a medical negligence case in which the QCA extended the limitation period.

Subscribe to our blog

Keep up to date with the latest news and developments in personal injury & insurance law by subscribing to our blog.

"*" indicates required fields

Categories

- Business Insurance

- Common Law Claims

- CTP Claim

- CTP Claim Time Limit Qld

- CTP Insurance

- CTP payout

- CTP time limit

- D&O Liability

- Examples of common law claims

- Income protection

- Insurance

- Insurance fraud

- Marine liability

- Medical Negligence

- Motor Vehicle Accident

- Motor Vehicle Accident Claim

- No Win No Fee

- Personal Injury

- Professional Indemnity

- Property Damage Claim

- Psychological Injury Claim

- Public Liability

- Public Liability Payout

- Transport accident

- Trip and Fall Cases

- WorkCover Death

- WorkCover payout

- Workers Compensation