Introduction

At Denning Insurance Law, we advise and act for clients who receive a Debt Notice (Debt) or Written Demand (Demand) from their CTP insurer after personal injury is sustained due to a motor vehicle collision. Such Debt or Demand usually indicates that the CTP insurer proposes to recover, from the driver, all sums of money paid to a person injured in the motor vehicle collision.

This article does not constitute legal advice, but it is designed to provide guidance to you if you receive such a Debt or Demand from your CTP insurer after being involved in a collision, and you were “under the influence” when driving.

The Relevant Legislation

Section 58 of the Motor Act Insurance Act 1994 (MAIA) is the relevant provision of the applicable legislation.

The relevant sub-sections of Section 58 MAIA state:

58 Insurer’s rights of recourse

(3) If—

(a) personal injury arises out of a motor vehicle accident; and

(b) the insured person was, at the time of the accident, the driver of the motor vehicle; and

(c) the insured person was, at the time of the accident, unable to exercise effective control of the motor vehicle because of the consumption of—

(i) alcohol; or

(ii) a non-medicinal drug or a combination of non-medicinal drugs; or

(iii) a combination of alcohol and a non-medicinal drug or non-medicinal drugs;

the insurer may recover, as a debt, from the insured person any costs reasonably incurred by the insurer on a claim for personal injury that are reasonably attributable to the insured person’s inability to exercise effective control of the motor vehicle.

…

(6) An action by an insurer under this section may be brought separately or by way of third-party proceeding.

Furthermore, the term “costs” is defined in Section 4 MAIA and includes:

- the amount paid out by the CTP insurer to, or for, the injured claimant, including rehabilitation services and medical and pharmaceutical expenses; and

- the CTP insurer’s legal costs and disbursements, including investigation expenses.

The Case Law

Surprisingly, there have not been many court decisions which have considered Section 58 MAIA. Some of the court decisions refer to CTP legislation in place before the MAIA was introduced in 1994.

The various authorities which have considered a CTP insurer’s right of recovery highlight the following salient points insofar as applying the legislation is concerned:

- Whether sufficient enquiries were undertaken by, and information was available to, the CTP insurer at the time of settlement to justify settlement with the injured claimant for the agreed settlement amount.

- Whether the costs of obtaining further information would outweigh the benefit from doing so.

- Overall, it is reasonable for a CTP insurer to adopt a ‘broad brush approach’ to negotiating and settling injury claims.

- A court will not make microscopic examinations of compromise arrangements which save costs and avoid the perils of litigation. This is because the likelihood of the parties succeeding in their claims/defences at an eventual trial of which prediction is always imprecise.

- The test as to what is a “reasonably incurred cost” is an objective test.

- Even if some of the CTP insurer’s costs were not “reasonably incurred”, that does not mean the CTP insurer cannot recover any costs which were reasonably incurred.

- Whether any evidence obtained at a later time may have caused a different result.

- Evidence of the advice received by the CTP insurer is relevant, but it is more important as to the reasoning that supported that advice to settle the claim and whether that was reasonable.

Driving with THC in your system in Qld

The law is constantly evolving. At Denning Insurance Law, we do not practise in Criminal Law nor Traffic Law, but this article’s consideration of Section 58 MAIA warrants commentary about medicinal cannabis. As indicated above, Section 58 MAIA makes specific reference to “non-medicinal drugs”.

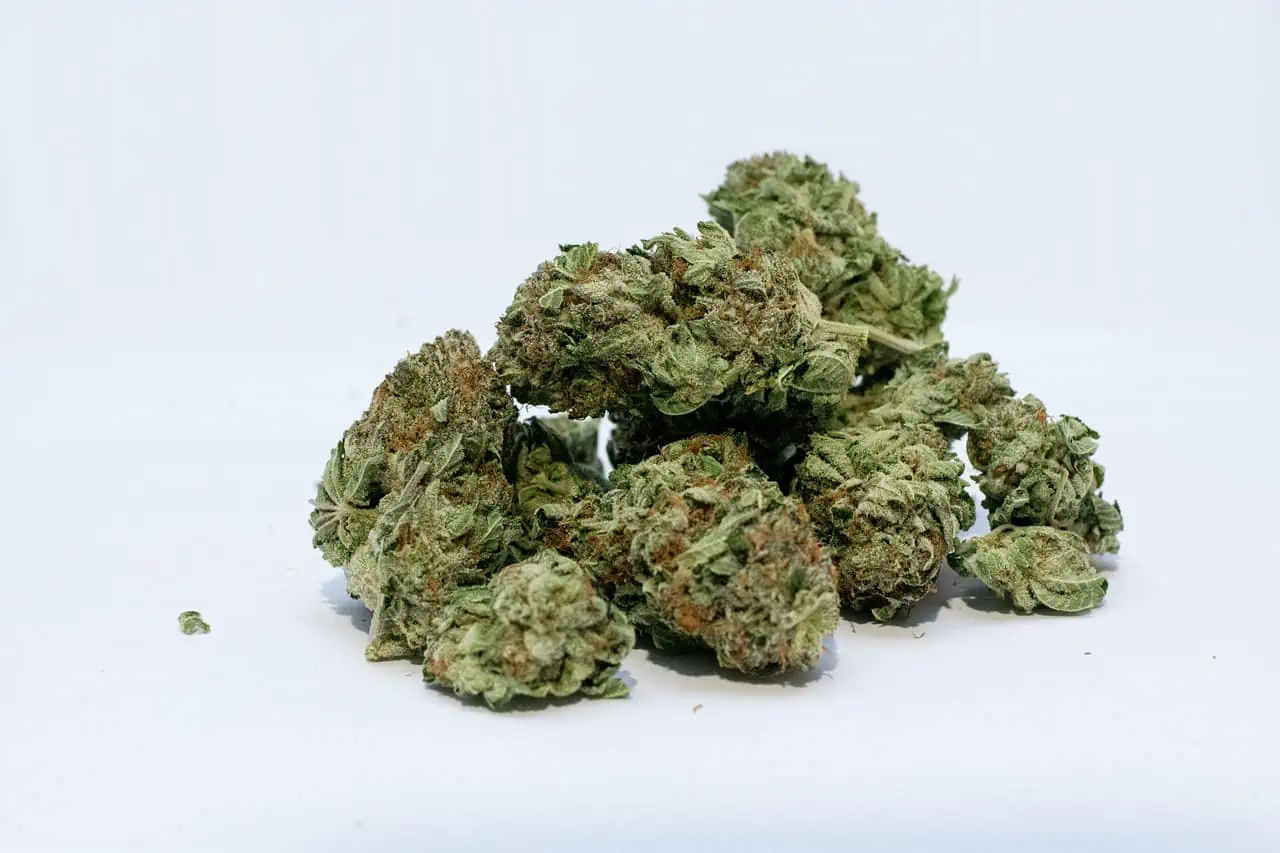

As the legal use of hemp and other cannabis products grows, consumers are becoming more curious about their health options. This includes cannabidiol (CBD) and tetrahydrocannabinol (THC), the two most common natural cannabinoids found in cannabis plants.

THC and CBD are in both marijuana and hemp. Marijuana contains much more THC than hemp, while hemp has a lot of CBD. CBD can be extracted from hemp or cannabis. CBD does not produce the “high sensation” associated with cannabis. THC is the main psychoactive compound in cannabis that produces the “high sensation”.

Section 4 MAIA defines a “non-medicinal drug” to mean “a drug other than one genuinely and lawfully consumed for medical or therapeutic purposes”.

There is a body of evidence demonstrating the disruptive effects that drugs, including cannabis, can have on safe driving performance. THC, being a psychoactive substance, may impair cognitive and motor function. Behind the wheel of a motor vehicle, such impairment may affect a driver’s ability to make decisions, anticipate hazards and unexpected situations, or respond quickly to changes in traffic conditions.

This therefore increases the risk of being involved in a motor vehicle crash. As a result, to protect the safety of all road users in Queensland, the Transport Operations (Road Use Management) Act 1995 provides that all road users must have no trace (i.e. zero tolerance) of any prohibited drugs in their system.

Nonetheless, despite the fact that Criminal Laws and Traffic Laws in Queensland effectively state that it is illegal for any person being treated with medicinal cannabis containing THC to drive a motor vehicle while undergoing treatment, on its face the MAIA is not as punitive when it comes to your CTP insurer’s right to recover a debt from the driver.

However, as this issue and the definition in Section 4 MAIA have not been tested by the Courts, we do recommend caution. As such, and although this article does not proffer legal advice, it would be prudent for any driver to ensure the drug is “genuinely and lawfully consumed for medical or therapeutic purposes”.

In that regard, a CTP insurer may take into account, when relying upon Section 58 MAIA, whether the driver took all and lawful, medical, therapeutic and reasonable steps to comply with the MAIA, such as:

- Whether they received professional medical advice (i.e. doctor or pharmacist) before consuming what may in fact be a “non-medicinal drug”

- The actual medical condition suffered by the driver and whether the prescribed drug does in fact assist, treat or combat that condition

- How the drug was purchased

- The strength of the drug

- Whether the driver read and observed all warnings provided with the medicinal drug

- How the medicinal drug was consumed by the driver and if the dosage was observed

- Ascertaining if the medicinal drug previously impaired their driving

- What other medication was consumed by the driver with the medicinal drug

- The journey or route being undertaken by the driver when the medicinal drug was consumed

- How the medicinal drug was stored by the driver

Implications

Customers should take note that CTP insurers are large and well-funded organisations which employ claims personnel who should be properly trained in terms of investigating and defending CTP claims. The staff employed by CTP insurers should be able to professionally run a file, consider the medical evidence, seek expert advice and achieve a reasonable settlement.

At Denning Insurance Law, we have the skills and experience to review how your CTP insurer handled the injury claim, in consideration of Section 58 MAIA, to ascertain whether the Debt or Demand sought from you by your CTP insurer can be maintained.

Based upon the authorities, we would be looking to assess whether any unreasonably incurred costs have been paid by your CTP insurer and/or whether your CTP insurer has diligently and effectively investigated and resolved the principal injury claim.

As the law is constantly evolving, and the application of the MAIA to medicinal drugs is largely untested, at Denning Insurance Law, we are able to assist you navigate untested legal issues.